Whats your goal?

Tax Saving Schemes

Invest in ELSS and save up to 46,350 in taxes as well as earn tax free market linked returns.

LEARN MORE

Long Term Saving Schemes

Secure your future financial wellness with the help of Finvasia’s artificial intelligence monitoring.

LEARN MORE

Short Term Saving Schemes

An Ideal Investment venue for your idle cash & earn up to 7-8% with no lock-in restrictions.

LEARN MORE

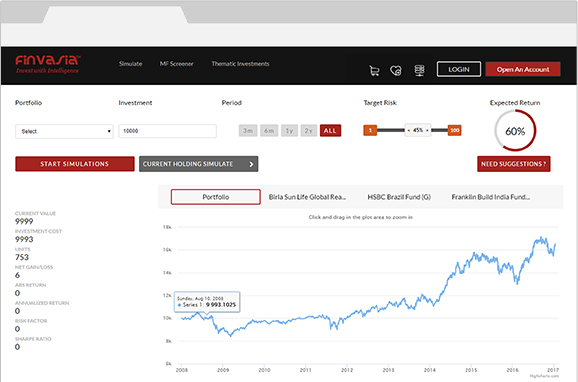

Analyze Your Portfolio

A complete set of research & analysis tools for your investment & make informed decision.

LEARN MORESelect Portfolio and Start Simulation now

Confused about in which mutual funds to invest or thinking about how to beat the market?

Now you don’t have to worry, with help of FINVASIA’s mf simulator you can easily test your portfolios

Create your own portfolio by selecting the mutual funds of your own preference and analyze its performance with respect to other portfolios or mutual funds.

OUR FEATURED FUNDS

Asset Allocation

Equity Sector Allocation

Mean

Standard Devation

Sharpe Ratio

Beta

Alpha

Treynor

Information Ratio

Sortino Ratio

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Fundmentals

5Y Return

3Y Return

1Y Return

Return Since Inception

Min SIP Investment

Expense Ratio

NAV

Risk

Scheme Type

NAV Chart

Top 10 Holdings

Company Name

Number of Shares

Percentage held

Market Value